Our model.

Agglomeration™

We offer business owners a solution that few others can; a platform to scale and the autonomy to do so in the way they feel is best. But our values are an integral part of that. This model doesn’t appeal to all and so in many ways it is self-selecting. We are genuinely drawn to honourable entrepreneurs, the kind you would be happy to take home and introduce to your mum. Through our own reputations and those that we bring in, it gets easier to attract good people. It may strike others as old-fashioned, but these are the people we want to work with.

A message from

Jeremy Harbour

"Unlike traditional models, we are neither looking to ‘strip and flip’ the businesses we acquire, nor are we interested in proving our managerial chops by buying struggling businesses and hoping we can turn them around where others have failed. Finally, we have no desire to merge all the businesses in our group into one cohesive brand with centralised command and control structure.

The businesses that join us are typically run by a founder who often has decades of experience in their industry. These founders are creative, they’re ambitious and they’re hungry for growth. Inevitably before finding us, they will have talked to other buyers in the marketplace, typically competitors, Private Equity firms and the like. The reason they are still independent when they come to us is that they value their independence, . They like the way they do business, they like their team and the way it works together. Their brand might not mean much outside of their country or even their niche, but it is their brand and their clients trust it. They have no interest in selling to others but will come to us because we allow them to scale in their own way.

We are not actually offering these business owners an ‘exit’ and we therefore do not get drawn into conversations about exit valuations. If founders want to sell their business and leave there are other options out there. We are most definitely not that solution, but we are a fantastic platform for those that want to scale.

An important part to the puzzle is that in almost every case we do our acquisitions using stock to compensate the founders joining us. Whilst the constant creation of shares is dilutive, each acquisition will be EPS accretive and we believe offers greater long term value creation for shareholders rather than using cash. As entrepreneurs ourselves we are all too aware of keeping cash on hand in case things don’t go to plan.

The entrepreneurs that join us are not looking to exit. Our model provides an ‘earn in’ approach where the more profit a business contributes to the holding company over time, the more shares they will earn. While not looking for an exit, the companies that join us are ambitious. They are looking to scale and they recognise that they can achieve more under the umbrella of a big PLC than on their own. The continuity that we offer, the ability to get on with the business in hand without worrying about rebranding, or merging with an unknown entity, allows the founder and their team to keep their focus on the business they are building. The model allows us enormous flexibility to work with great companies regardless of sector or territory as long as it enhances shareholder value. This continuity and flexibility offers us a fundamental competitive advantage."

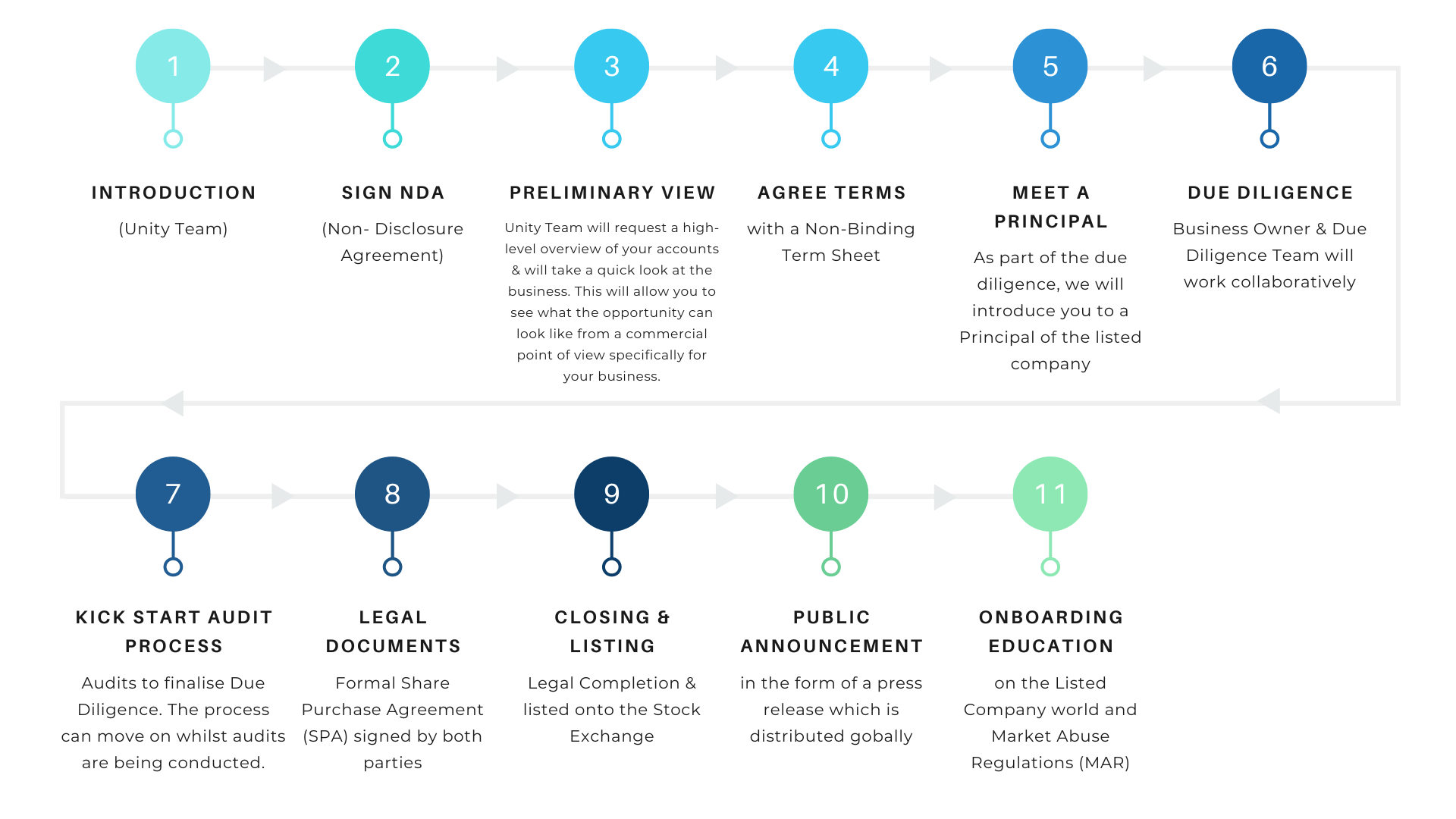

Our Process.

A simpler way to scale

Our Listings